The formula to calculate shareholders equity is equal to the difference between total assets and total liabilities. As a result, when companies liquidate or go through a bankruptcy restructuring, common stockholders generally receive nothing, and their shares become worthless. The dividend growth model for common stock valuation assumes that dividends will be paid, and also assumes that dividends will grow at a constant pace for an indefinite period.

- Get instant access to video lessons taught by experienced investment bankers.

- Common and preferred stock both let investors own a stake in a business, but there are key differences that investors need to understand.

- In most cases, retained earnings are the largest component of stockholders’ equity.

- First, determine the preferred stock’s annual dividend payment by multiplying the dividend rate by its par value.

- Companies fund their capital purchases with equity and borrowed capital.

What is preferred stock?

We may earn a commission when you click on a link or make a purchase through the links on our site. All of our content is based on objective analysis, and the opinions are our own.

Comparing Benefits and Rights

This comparison underscores the distinctive roles and potential impacts of owning different types of stock in a corporation’s financial structure. Now, if the probability of a stock-out is acceptable to be less than 10%, the stocks for safety can be 2000 pairs. However, we need cumulative probabilities the shadow if we want to predict the likelihood of stock-out, which is the main purpose of keeping safety stocks. When customers know they can count on your business to provide the products they need, even during peak demand or supply chain disruptions, their trust in your brand increases.

Defining Preferred Stock

Unlike interest payments on bonds, dividends on preferred stock are not mandatory and generally are not tax-deductible for the corporation. However, they might still be less costly than the higher interest rates a company might have to pay to entice bond investors. Capital stock is an encompassing term referring to all types of shares, including both common and preferred stock, that a company can issue as stipulated by its corporate charter.

What Are Common Stocks?

Both of these can be found in the company’s preferred stock prospectus, and par value is usually $25 or $50 per share, although there are exceptions. To manage this challenge, consider adopting a flexible safety stock policy that allows for adjustments based on real-time data using inventory management software and changing market conditions. This approach will ensure you have enough buffer stock to manage uncertainties without overcommitting resources.

Analyzing Common Stock in Investment Decisions

Depending on the company, common stock may also entitle its owner to a share of the company’s profits, in the form of dividends. Now companies from China can issue common stock to investors in the United States and vice versa as long as they adhere to the rules governing the exchange. Either one of those consequences translates to potential losses for investors in the company’s common stock because they affect its common stock price.

The outstanding stock is equal to the issued stock minus the treasury stock. In the event that a company goes bankrupt and has to sell off all of its assets, common stock owners are the last to get any money from those sales. This is more common in some sectors of the stock market — such as the energy sector — but less common in others, such as the technology sector. Typically, energy companies such as oil stocks like to return profits to shareholders, while technology stocks prefer to reinvest them in their own growth.

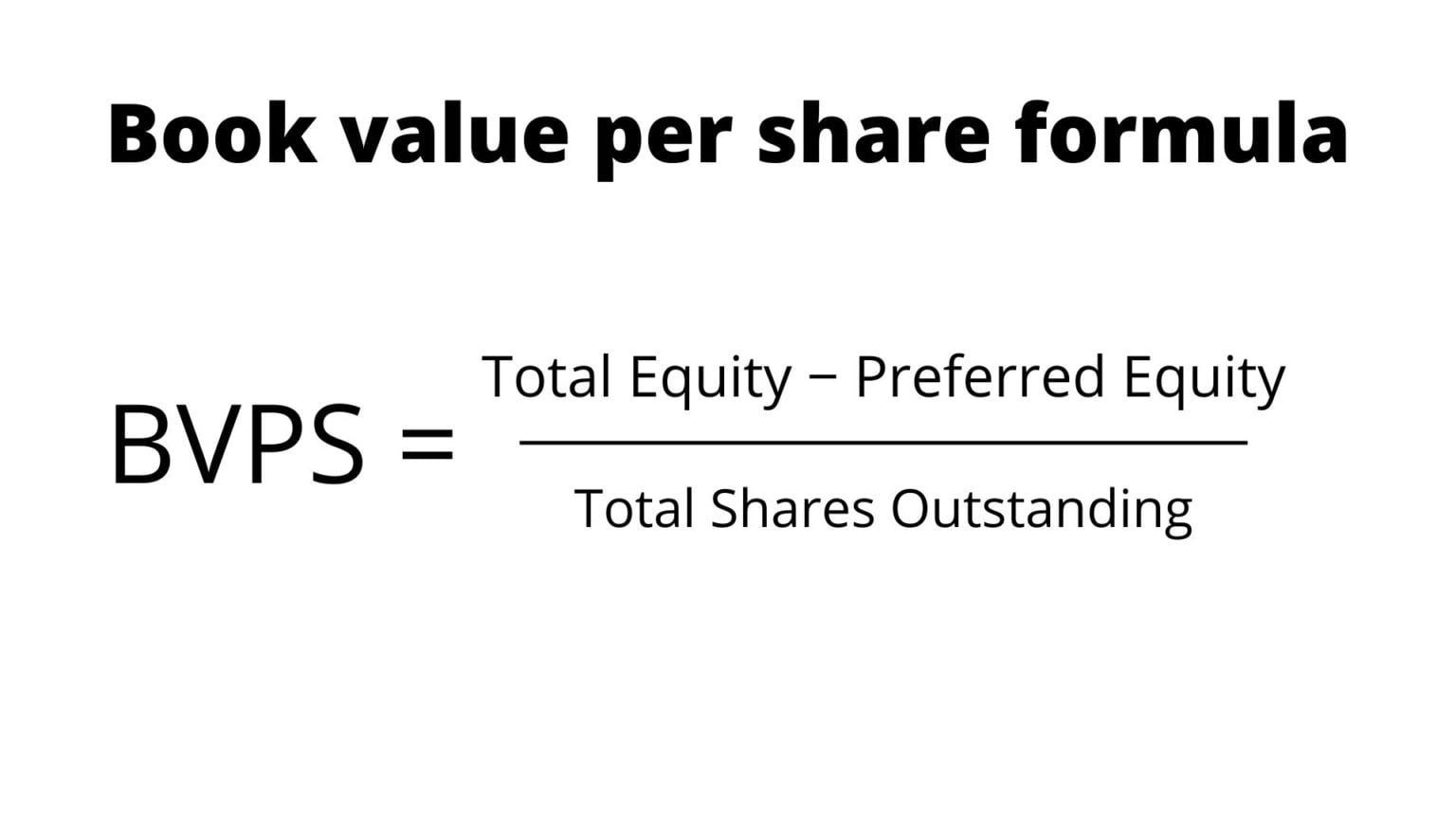

It represents the assets, liabilities, and stockholder’s equity at a particular point in time. It records the company’s income and expenditure and compares it with the previous year’s data, and results out the company’s net profit and loss. Here we will discuss how to calculate common stocks, and preferred stocks also play a role in calculating common stocks. For example, if you aim for a high service level and use a Z-value of 3, you are ensuring that your safety stock covers three times the standard deviation of both demand and lead time. Now, we know that the safety stock level must be between 1050 and 2090 pieces.

Utilizing formulas that factor in lead times, average demand, and service levels will help you find a balance that aligns with your operational goals. Lastly, when a company’s assets are liquidated due to insolvency, the creditors and bondholders are paid first, followed by preferred stockholders. Common stockholders are the last to receive any proceeds from a liquidation. In bankruptcy proceedings, common stockholders often end up with nothing for their ownership. One of the most significant drawbacks of preferred stock is that it generally doesn’t benefit from the same level of price growth as common stock.