Preferred stock is listed first in the shareholders’ equity section of the balance sheet, because its owners receive dividends before the owners of common stock, and have preference during liquidation. Its par value is different from the common stock, and sometimes represents the initial selling price per share, which is used to calculate its dividend payments. The number of outstanding shares, which are shares issued to investors, is not necessarily equal to the number of available or authorized shares.

Get in Touch With a Financial Advisor

So, in this case, the number of shares issued is equal to the company’s outstanding shares. Companies sometimes buy back shares, which is part of their corporate strategy. If the company buys back its shares, that portion of the share is with the company, and the equity owners do not own that share. In the event of bankruptcy or liquidation, common shareholders are last in line to receive any remaining assets. Creditors, bondholders, and preferred stockholders all have claims before common stockholders, meaning there may be little to nothing left for them.

Conversion Calculators

- When customers know they can count on your business to provide the products they need, even during peak demand or supply chain disruptions, their trust in your brand increases.

- Stockholders’ equity is also referred to as shareholders’ or owners’ equity.

- Finally, multiply the number of missed dividend payments by the quarterly dividend amount to calculate the cumulative preferred dividends per share that you’re owed.

Significant differences between the book value per share and the market value per share arise due to the ways in which accounting principles classify certain transactions. Investing in common stocks allows shareholders to benefit from the companies’ potential success through capital gains and, sometimes, dividends, although these are never guaranteed with common stock. When you own common stock, your return on investment is tied to the company’s performance. If the company does well, the stock price can rise, allowing you to sell at a profit. Common stockholders may also receive dividends, although they’re not guaranteed and depend on the company’s profitability.

Practical Insights into Common Stock Valuation

There are a few exceptions to this rule, however, such as companies that have two classes of common stock — one voting and one non-voting. The company’s class A shareholders (GOOGL -0.28%) have voting rights, while its class C shareholders (GOOG -0.26%) statement of changes in equity do not. This is often arrived at by adding a percentage for risk premium to the T-Bill rate. Note that the required rate of return must be greater than the stock growth rate in order for the dividend growth model to be used for common stock valuation.

Calculator Instructions

For example, imagine running a retail store, and suddenly, you run out of stock for a popular item just before a holiday sale because there was higher pre-holiday demand. This could mean lost revenue and frustrated customers who may choose to shop elsewhere. For example, if you sell high-demand products with demand variability, the signal stock will be the amount of that product you will have on hand (let’s say 500 pieces) to signal when to reorder. So when the inventory of that product becomes 500 pieces, it will give you a signal to start ordering or producing more of that product.

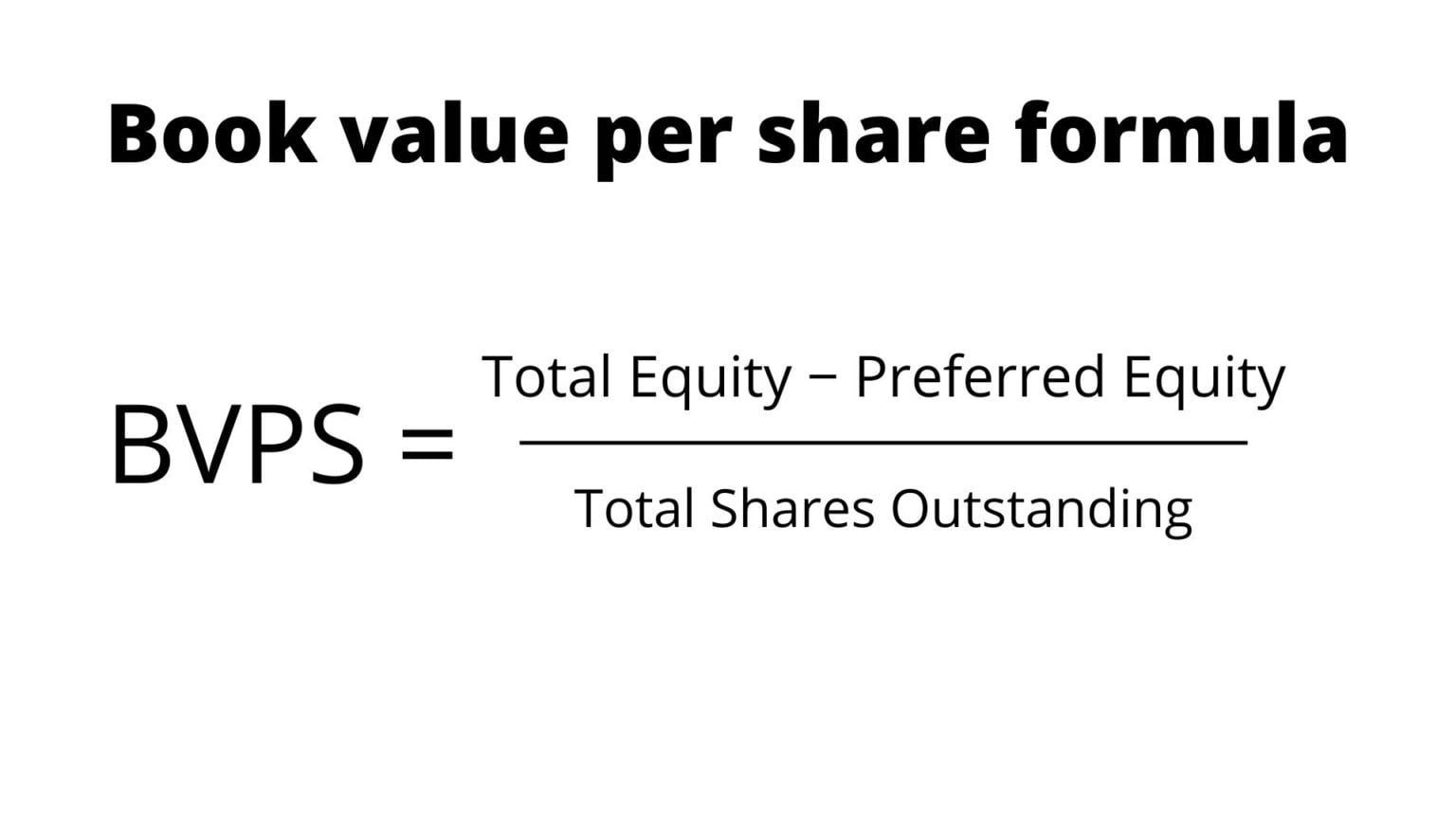

Since repurchased shares can no longer trade in the markets, treasury stock must be deducted from shareholders’ equity. When companies issue shares of equity, the value recorded on the books is the par value (i.e. the face value) of the total outstanding shares (i.e. that have not been repurchased). Total par value equals the number of preferred stock shares outstanding times the par value per share.

The value of safety stock is seen during unexpected events such as sudden demand surges, supplier delays, or natural disasters that affect logistics and the supply chain. Having safety stock allows you to manage and mitigate these challenges without disrupting your operations. For example, if you have an online store, having safety stock means that even during a holiday rush or supply chain problem, your customers will get their orders on time. So, even I usually look at safety stocks as a “necessary evil” because companies usually use them to cover problems inside their own processes or supplier’s processes.

Market demand may increase the stock price, which results in a large divergence between the market and book values per share. Will has written professionally for investment and finance publications in both the U.S. and Canada since 2004. A native of Toronto, Canada, his sole objective is to help people become better and more informed investors. Fascinated by how companies make money, he’s a keen student of business history.

An example of country and foreign exchange-specific risk would be investing in the common stock of a Latin American company listed on a U.S. stock exchange. South American countries often have very precarious political structures. When combined with the region’s highly volatile currencies, the investor adds additional risk beyond the business. First, if a company liquidates its business, once the debtholders are paid in full, any funds left over go to the shareholders.

Common stock affects the balance sheet by increasing the equity section. When a company issues shares of common stock, it gets money from investors, increasing the common stock balance in its financial records. This money, representing the amount of common stock sold, is recorded as paid-in capital in the equity section. It shows that the company has more resources because of the investment from common shareholders. However, investors generally trade common stocks rather than preferred stocks.